Kenya has stepped up oil and gas exploration activities in the Lamu Basin weeks after rejecting a ruling over a four-decade maritime dispute with Somalia.

Petroleum commissioner James Ng’ang’a said that ENI Kenya Business Venture (BV), formerly Agip, started drilling last month at Mlima-1 well, which is also known as Block L11B.

This follows seismic surveys that revealed the area has potential for oil and gas. The company expects to release deposits results of the block in terms of commercial viability in the next two months.

“The spudding of the well was conducted on December 28th 2021 and is expected to last for two months,” Mr Ng’ang’a told the Business Daily.

Oil and gas explorers use seismic surveys to produce detailed images of the various rock types and the location beneath the earth’s surface and to determine the location and size of potential oil and gas reservoirs.

Mr Ng’ang’a added that the country will abandon the venture in case the well turns out dry at the end of the drilling and mining assessment within the 60 days.

Since April last year, Kenya has been mapping for oil and gas deposits in the Lamu Basin despite a border row over the area with Somalia.

The basin stretches from the Kenya-Somali border to the boundary with Tanzania and the ministry banking on its vastness to secure Kenya oil production wells.

But the basin lies within the disputed territory with Somalia that has been the cause of diplomatic spats between the two countries.

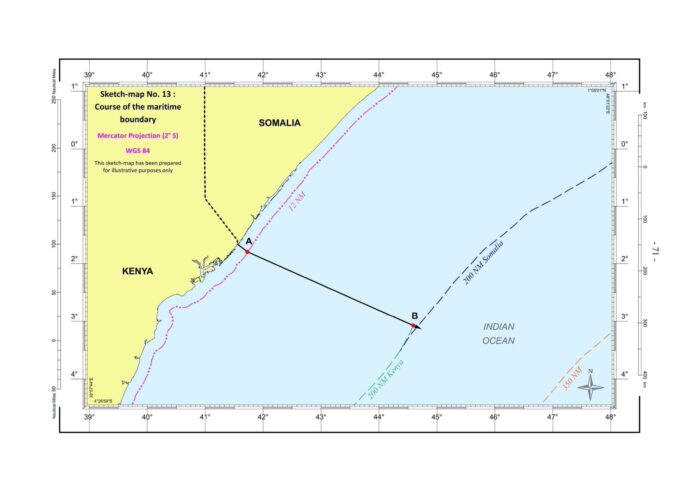

Somalia lodged the case over the 100,000 square kilometre coastal strip believed to harbour oil, natural gas and mineral reserves before the International Court of Justice (ICJ) in August 2014.

Kenya accused Somalia of auctioning exploration rights in the disputed maritime territory in the Indian Ocean, with Nairobi even recalling its ambassador to Mogadishu two years ago.

President Uhuru Kenyatta last year said Kenya will not cede even an inch of the disputed area, highlighting Kenya’s resolve to protect an area that is critical to the path to becoming an oil-producing nation.

The country rejected the maritime dispute ruling in totality and accused the International Court of Justice of bias.

Kenya wrote to the United Nations in 2016 seeking authority and expertise to map out its territorial waters to enable it exploit huge oil, natural gas and mineral reserves believed to be underneath the Indian Ocean sea bed.

MARITIME BOUNDARY

But the ICJ last October ruled in Somalia’s favour and rejected Kenya’s claim that there was an existing agreed maritime boundary between it and Somalia and instead drew a line that split the disputed area into two.

The wells in the Lamu Basin offer Kenya another chance to become an oil producing country following the longer than anticipated wait in commercialising the South Lokichar venture.

Kenya first announced the discovery of oil in Block 10BB and 13T in Turkana in March 2012, raising hopes of petro-dollars needed to fuel economic growth. But the country is yet to fully commercialise crude oil a decade later.

The country had set a December 2021 deadline for Tullow to present a comprehensive investment plan for oil production in Turkana or risk losing concession on two exploration fields in the area.

Tullow in October last year presented a revised development plan for oil production in South Lokichar Basin.

PROCESSING FACILITY

The plan includes land for development of a pipeline and oil processing facility that will pave the way for compensation of more 516 landowners in Turkana County needed to relocate and free up the area.

Relocation of the landowners will pave the way for the planned development of a pipeline and oil processing facility in the basin that includes $3.4 billion (Sh373.6 billion) investment for upstream activities.

Tullow has said that the land acquisition hitches coupled with unfavourable global oil prices since 2014, a tax dispute and Covid-19 disruptions have delayed Kenya’s bid to commercialise the Turkana oilfields.

Global oil prices hit a three-year high in September last year of $80 (Sh8,800) a barrel highlighting the lucrative business for Kenya’s oil.

Tullow, however, says that more than 80 percent of Kenya’s estimated 2.85 billion barrels oil reservoir remain inaccessible for commercial exploitation due to limitations in extraction technology underlining the vast resources needed to join the league of oil producing nations.

Kenya will not, however, earn the whole amount when production starts, with a big percentage going towards production and shipping costs.

Tullow is also entitled to recover its exploration costs from the crude sales, which further eat into the country’s earnings from the commodity. Countries with oil deposits periodically update the estimates of recoverable reserves as extraction technology evolves.

British petroleum consulting firm Gaffney Cline Associates (GCA) in an audit last year increased Kenya’s commercially extractable oil volume to 585 million barrels from the previous estimate of 433 million barrels.

Kenya has four petroleum exploration basins including Lamu. The others are Anza, Mandera and Tertiary Rift Basin.